Premium chocolate brands missing from Nestlé’s locker, says Euromonitor

Last week, Nestlé reported a 24% drop in first half confectionery operating profits, which it blamed on spiraling cocoa costs and intense competition.

Speaking to ConfectioneryNews, Pinar Hosafci, food analyst at Euromonitor said: “Nestlé is definitely trying to move into premium because their mass market brands just aren’t cutting it.”

The company recently opened a $16m chocolate molding and packaging line in Ecuador that will make use of fine flavor Arriba cocoa beans for Nestlé’s UK Quality Street brand, which will move to single origin cocoa only.

What’s out there?

Hosafci said the Ecuadorian line was a bold move considering Nestlé lacked premium brands to go with fine chocolate. She said the firm needed to shop around to strengthen its premium proposition.

“There are a couple of premium brands that the company can look into.” She flagged Lebanese chocolate brand Patchi. The company is present in 29 countries mostly in the Middle East, Africa and Asia-Pacific, albeit only in its own boutique stores.

The analyst also noted North American brand Vosges Haut Chocolat, which uses exotic flavors such as Mexican chilies and paprika, as another possibility that would give Nestlé a stronger footing in the US, where consumers are switching to premium products.

Ferrero and Lindt out

Nestlé recently lost third place in the US chocolate confectionery market to Lindt after its Swiss counterpart acquired Russell Stover in July.

Nestlé had previously been linked with a move for Lindt, but the latter’s Russell Stover acquisition suggests it’s not for sale, said Hosafci.

Nestlé reportedly made an offer for Ferrero in October last year. However, the Italian confectioner denied any approach had been made and said the firm was “not for sale to anyone”.

Hosafci said alternatives for Nestlé were Hotel Chocolat in the UK, Confisserie Sprüngli in Switzerland, Lotte’s Belgian brand Guylian or Yildiz Holding’s Godiva business.

Existing premium portfolio

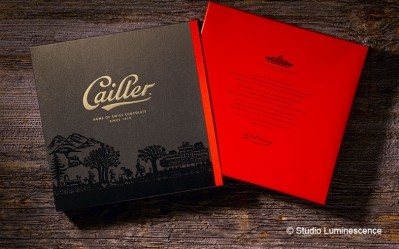

Nestlé confectionery range features mostly mass market brands such as Kit Kat, Aero, Butterfinger and Crunch. The company’s only truly premium product is Swiss chocolate brand Cailler.

“It’s a really niche brand and not really known outside of France and Switzerland. Nestlé doesn’t really invest in the brand as part of its international expansion strategy,” said Hosafci.

Cailler holds a 6% market share in the Swiss chocolate market, which has been stagnant for the past five years, according to Euromonitor figures.

Premimizing Kit Kat

Nestlé has premiumized Kit Kat in both Asia Pacfic and Latin America. The firm recently opened Kit Kat stores in Japan, which sell premium Kit Kat products. It also launched Kit Kat in Brazil in 2011 as a premium product, which has proved successful to date.

Asked if Nestlé could do the same in developed markets, Hosafci said: “It’s risky because Kit Kat is known to be mass market – it works better in developing markets.”

UPDATE: The company's Indian subsidiary today (8/13/14) launched a series of advertisements for its Alpino brand to increase its competitiveness in India’s premium chocolate market.