Brand power continues to diminish private label confectionery: IRI

The research firm this month published its ‘Private Label in Western Economies’ report, which analyzes own label markets in the UK, France, Italy, Spain and the Netherlands as well as Australia and the US.

Private label value market share for 2015 was 38.3% in Europe for all FMCG categories, while in some sectors – such as frozen foods (43%) – private label manufacturers were the market leaders.

But in confectionery, private label had only a 12.1% value share in Western economies in 2015, according to IRI’s findings.

Tim Eales, director of strategic insight at IRI, told ConfectioneryNews: “Traditionally it’s not been an area where private label has a stronghold due to the strength of the brands.”

Germany driving value sales

In the six European countries analyzed, private label confectionery value sales were pegged at €2.5bn ($2.8bn), up 3.6% on the prior year and enjoying faster growth than branded confectionery in these markets (+3.2%).

But Eales said: “It is only in Germany where the share is going up. There’s a lot more places where private label confectionery is under pressure.”

Private label confectionery value share: 2015 vs 2014

France: 10.2%

-0,2pt

Italy: 5%

-0.1pt

Spain: 25.7%

0pt

UK :8.8%

- 0.4pt

Netherlands: 13.6%

-3.4pt

Germany: 14.1%

+0.6pt

US: 3.3%

0pt

Germany is the largest European market for private label confectionery, according to IRI.

Private label confectionery’s value share was up 0.6% in Germany, accounting for 14.1% of the market.

But private label confectionery’s value share was flat or declining in every other Western economy analyzed by IRI, including the US and Australia.

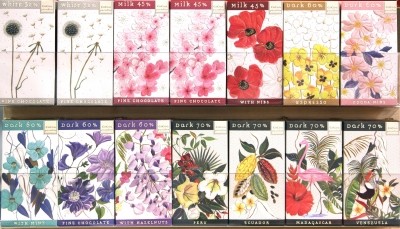

Private label goes upmarket

Eales said it came as premium ranges at retailers were outpacing economy products.

“The private label sector is responding with more products at the premium end of the market, which is delivering value growth,” said the analyst.

“As the brands work hard to maintain their position in stores and their prices come down, private label will continue to find it difficult in 2016,” he added.

“I would imagine we’re going to see much of the same in terms of the slow decline [in value share],” he concluded.