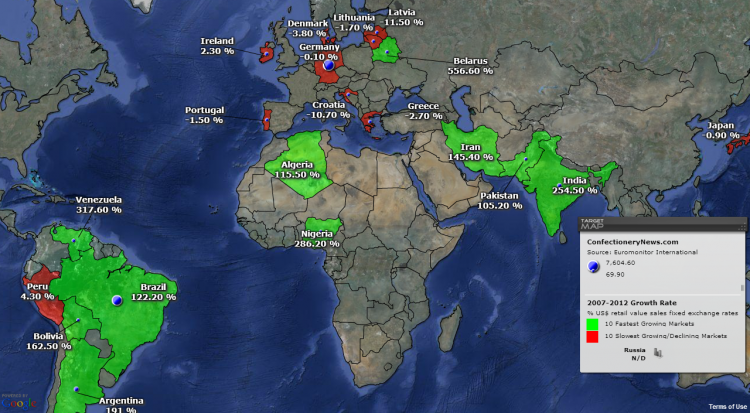

Interactive Map

Global chocolate markets: Biggest sinkers and risers

The figures represent the growth rate in retail value sales from 2007-2012 and come courtesy of Euromonitor.

Which global chocolate markets have weathered the recession and which have collapsed?

Shakers: Baltic states and Eurozone

Latvia was the fastest declining market of the past five years, while other Baltic and Eurozone countries were among the 10 worst, such as Lithuania, Croatia and Portugal.

Lee Linthicum, head of food research at Euromonitor said: “A lot of the Baltic markets were not expecting a full recovery until 2013-14”

“It’s down to the economic deterioration,” he said, adding that branded goods were put under further pressure from private label discounters.

However, he said: “We see retail volume growth stabilizing and returning to pre-crisis levels.”

He added that although Romania was outside the top 10 worst affected markets it was still among the slowest markets globally and many companies had lost out, such as Ferrero and Perfetti Van Melle, while local players had been squeezed out as input costs rose due to sky-high cocoa prices.

“A lot of premium end stuff has collapsed,” he said.

Established markets such as Germany and Japan were also among the slowest growing over the past five years.

Click HERE or on the map for full view.

Movers: Brazil and a caution

Belarus was the fastest growing chocolate market in recent years, but Linthicum said this should be treated with caution as prices are set by the government and are not a reliable indicator.

He added that inflation rates in Argentina and Venezuela overstated the chocolate sales growth in these countries.

According to Linthicum, the strongest market remains Brazil largely due to the strength economy. Compared to other developing markets not only are people eating more chocolate but they are spending more to buy it by opting for premium products, he said.

Africa developing

Some African markets have made big gains in the last five years. Linthicum said that Algeria, Nigeria and Morocco had made economic progress during the period, which had accelerated chocolate sales.

“That’s a function of increasing wealth and modern formats such as refrigeration,” he said.

However, he warned that chocolate sales were still small in comparison to the developing BRIC nations.

10 fastest growing chocolate markets 2007-2012

The global average sales growth during the period was 30.8%.

Country | 2007 (Retail Value Sales) US $ | 2012 (Retail Value Sales) US $ | Growth % |

Belarus | 42.4 | 278.4 | 556.6 |

Venezuela | 89.3 | 372.9 | 317.6 |

Nigeria | 18.1 | 69.9 | 286.2 |

India | 340.4 | 1,206.7 | 254.5 |

Argentina | 550.1 | 1,600.7 | 191.0 |

Bolivia | 39.7 | 104.2 | 162.5 |

Iran | 135.0 | 331.3 | 145.4 |

Brazil | 2,979.1 | 6,620.6 | 122.2 |

Algeria | 317.0 | 683.1 | 115.5 |

Pakistan | 42.2 | 86.6 | 105.2 |

10 slowest growing chocolate markets 2007-2012

Country | 2007 (Retail Value Sales) US $ | 2012 (Retail Value Sales) US $ | Growth |

Peru | 238.4 | 248.7 | 4.3 |

Ireland | 712.1 | 728.8 | 2.3 |

Germany | 7,613.5 | 7,604.6 | -0.1 |

Japan | 4,368.4 | 4,329.7 | -0.9 |

Portugal | 317.8 | 312.9 | -1.5 |

Lithuania | 139.1 | 136.7 | -1.7 |

Greece | 424.7 | 413.3 | -2.7 |

Denmark | 550.6 | 529.8 | -3.8 |

Croatia | 370.0 | 330.4 | -10.7 |

Latvia | 98.6 | 87.3 | -11.5 |