Thorntons to make biggest capital investment in 25 years

“Newfound growth in volumes and management’s growing confidence in future growth has led the business to confirm additional manufacturing investment over the next years,” said analysts at N+1 Singer.

Thorntons confirmed planned capital expenditure was likely to total £30M, comprising £10M each year for the next three years up to the close of the 2017 financial year. The move doubles annual capital expenditure for the company, it confirmed to FoodManufacture.co.uk.

The investment would bolster capacity in decorated hollow Easter eggs and other seasonal lines, Thorntons said. It would also enable the installation of a moulding line for inlaid boxed chocolates, adding to an existing line and doubling capacity for these products, it added.

Combined, these two projects “represent the biggest manufacturing investment for 25 years”, said N+1 Singer analysts Matthew McEachran and Mark Photiades.

The firm posted strong half-year results, with pre-tax profit in the 28 weeks to January 11 ahead of expectations at £7.2M, up from £4.2M in the same period last year.

Well ahead

Despite that figure taking a £1M hit from lease and store costs, it was still well ahead of 2013 full-year pre-tax profit, which stood at £4.3M, Thorntons reported.

Half-year revenue also rose by 4.5%, from £133.7M in the same period of 2013 to £139.7M.

The company had achieved positive results across all of its core channels, including retail and commercial, said ceo Jonathan Hart.

Sales in the company’s fast moving consumer goods (FMCG) business grew by a powerful 14.5% to £70.6M, up from £61.6M in the previous period.

Strong performance

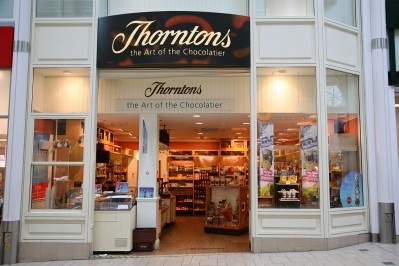

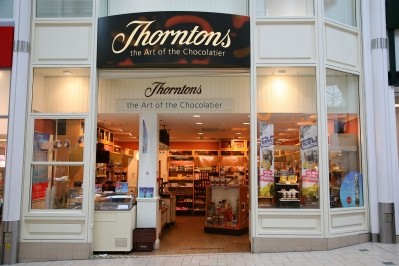

Retail sales achieved 2.1% like-for-like growth, driven by a strong performance in stores under the Thorntons fascia and online consumer direct sales.

Consumer direct sales increased by 23.4% to £4.1M from £3.3M. Franchise sales grew slightly, as did international sales. UK commercial sales grew by 17.3% to £62.4, from £53.2M in the same period last year.

Plans to close 40 Thorntons stores during the financial period were on track, it said. It had closed 15 stores in the half-year period as it aimed to prune the estate down to 180–200 stores in the medium-term.

The relaunch of its Classics and Nostalgia ranges had been well-received and the response to seasonal specialities had exceeded expectations, added Hart. Specialist Christmas lines had grown by 68%, the company reported.

"We are pleased to report further increases in both revenues and profits as we continue on our journey of transforming Thorntons towards an international FMCG business and UK multi-channel retailer,” said Hart.