Brazil’s Dori eyes North America export growth

Dori had considered building a US factory but decided against a US manufacturing base.

Too early for US factory yet

Carlos Bodini Barion, president of Dori Alimentos told ConfectioneryNews: “Internationalization is still part of Dori’s plans, reinforcing our position with a potential presence in North America. However, the strategy is to have a warehouse branch that allows us to participate in the market with smaller volumes, besides what is already exported to that market.”

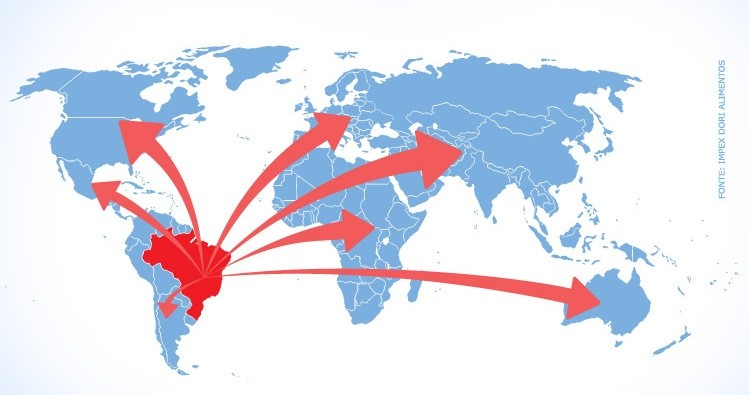

Dori exports to around 60 countries and exports accounts for 16% of the company’s net revenues. The US is a key market for the firm with 35% of its exports sales coming from the country.

The Dori president continued “It was never our plan to get into retail with the Dori brand [in the US], but rather to continue serving clients who already have an established market with our products.”

He said that at this stage there was no justification to construct a US plant, at least in this phase of the company’s development.

Entering snacks and building caramels business

Dori is already known in the US for its confectionery products but plans to explore new areas.

“The novelty is that we also intend to compete in the snack category, offering peanut-based products, which we will introduce to the North American market during the Sweets & Snacks Expo in Chicago,” said Bodini Barion.

“We also intend to be more competitive in sweets. For example, we want to export milk caramels at the same proportion we already export gummies, chewable caramels and soft drops.”

New innovation center in Brazil

Dori has a capacity of 9,000 metric tons of chocolate, gum, candy and lollipops across its three plants: two in São Paulo and one in Rolândia. It posted sales of R$550 million (US $246m) in 2014

The company is currently building a 1,793 m² innovation and technology center in São Paulo in order to train employees and develop new products. It received R$13.6 m (US $6m) in funding for the project from Finep – Innovation and Research.