Europe set for bittersweet summer as sugar supply crisis looms: CIUS

The Committee has spoken out in the past against EU production quotas which cap supply to around 80% of its needs.

The total quota is set at 13.5 million tonnes of sugar, which is divided between nineteen member states, and strict rules govern the use of any production that is in excess of this, known as 'out-of-quota' sugar. According to the Directorate General for Agriculture and Rural Development, it can be exported up to the EU's annual World Trade Organisation (WTO) limit of 1.374 million tonnes, sold for biofuel or other industrial non-food uses, or counted against the following year's quota.

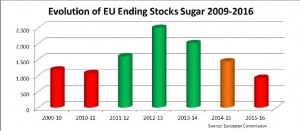

In 2010 and 2011, the EU experienced a major supply crisis, but current stocks are even lower, said the committee which represents European sugar-using firms such as Mondelez International and Nestlé, and whose members purchase and use almost 70% of Europe's annual consumption of sugar.

It is calling on the EU to lift levies and duties applied to volumes of beet and cane sugar made available through access to these ‘out of quota’ sugar stocks.

Secretary general of the committee, Muriel Korter, told FoodNavigator: "According to the Commission, the out-of-quota volumes forecast in their balance sheet would be sufficient for a market measure that they can take in reclassifying the volume as quota sugar is decided and thus, make it available to the food and drink industries."

"For CIUS the issue is not about price but about supply," she added.

A repeat of history

"Given that the EU has all the necessary data to foresee such problems, the EU should act before such problems occur, and avoid a repeat of history,” the committee said, warning that the first countries likely to be hit by shortages would be Europe’s outer regions where little beet sugar is produced.

"In 2010/2011, these countries faced shortages with retailers running out of stocks of sugar for direct consumption. Sugar users also were directly impacted, with some companies having to temporarily suspend production lines or close down their export business."

The EU has taken direct action in the past. In response to the crisis in 2010 and 2011, the European Commission released 500,000 tonnes of ‘out-of-quota’ sugar onto the EU market and backed open an import quota for 300,000 tonnes of raw or refined sugar at zero duty. It stressed at the time that the measures were in response to the current exceptional market circumstances which saw the EU sugar market in deficit and world market prices above average EU levels.

The CIUS is also calling for the suspension of the CXL duty, which The CXL import grants preferential access to the EU market to countries that may have otherwise lost out on trade as countries like Finland, Portugal, Bulgaria and Romania joined the EU.

Sugar giant Tate & Lyle has long campaigned against the duty of €98 per tonne levied on around 30% of raw cane sugar imports which it has slammed as unfair and out-of-date.

“The CXL duty was understandable in the 1990s where European agricultural markets were driven by very high support prices and vast expenditure on ‘food mountains’ and export subsidies. All of these elements have now gone. The time is right for the CXL duty to go as well,” it says.

The European Commission did not reply in time for publication of this article.